Telus Stock Prediction 2025

- Current Telus Stock Price: 21.59 CAD as of June 22,2024

- Telus Stock Prediction for 2025: Can Hit More Than $25 Before Mid of 2025

Should You Buy Telus Stock in 2024?

Canadian Stocks on the Rise

Canadian stocks have been rising this year, supported by solid quarterly performances at prominent companies and an improving macro environment, with inflation showing signs of easing. The TSX S&P Composite Index is up 2.7%.

However, several economists predict the global economy will slow down this year due to monetary tightening. The ongoing geopolitical tensions could also hurt economic growth. So, equity markets could be volatile in the near term.

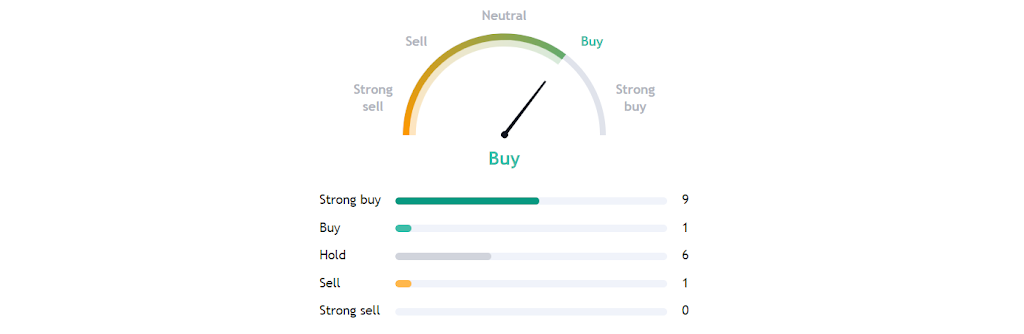

Analyst Projections

The average 12-month price target for Telus is around $25.67, with estimates ranging from a low of $20 to a high of $31. These targets suggest a potential increase of about 62.88% from the current stock price of approximately $15.76

Revenue and Earnings Growth

Telus is expected to continue its revenue growth, projected to reach about $21.79 billion by 2025, up from $20.99 billion in 2024. Earnings per share (EPS) are also expected to grow, indicating robust financial performance

Strategic Investments

Telus’s investments in expanding its 5G network and recent acquisitions, such as LifeWorks Inc., position it well for future growth in the telecommunications sector

Telus Stock Investment Benefit

Telus, one of Canada’s three top telecom players, would be another top dividend stock to have in your portfolio. It gained 404,000 customers in its most recent quarter, representing a 34% increase over the previous year.

Solid Operational Execution

Management credited the increase to solid operational execution and the strong demand for its bundled product offerings across fixed and mobility services. Its churn rate for the year stood at 0.87%, marking the 10th consecutive year of less than 1% of churn rate.

Investors’ Takeaway

Investors are bullish on Telus because of the growing demand for telecom services. Its other business segments are also growing at a healthy rate, making it an attractive buy. Considering these factors, it is feasible that Telus’s stock price could exceed $25 before the middle of 2025.

Latest Stock’s Forecast

- Air Canada Stock Prediction 2025

- CNR Stock Price Forecast 2025

- Drone Delivery Canada Stock Prediction 2025

- Looking Glass Labs Stock Price Prediction 2025

However, investors should also be aware of potential risks such as intense industry competition and regulatory changes that could impact the company’s profitability

Important: Please do your own research before investing in any of the stocks.