Canada boasts a robust and stable economy, making it an attractive destination for investors seeking long-term growth. The country’s prudent financial regulations and policies contribute to a favorable investment climate.

Canada’s technology sector has been on the rise, with innovative companies driving growth. Investing in tech stocks can be a strategic move for those eyeing future-oriented industries.

In this article, we’ll talk about the 4 best Canadian stocks to buy right now in the market, exploring why it’s a promising arena for investment and identifying some hidden gems priced under $35.

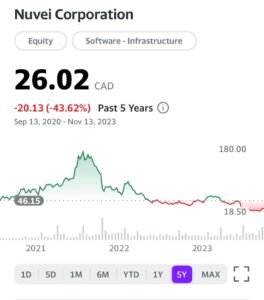

1. Nuvei: (TSX: NVEI)

The company’s management attributes the downward revision to longer-than-expected delays in securing new business and the termination of its association with a major customer. Despite these challenges, I am of the opinion that the market reaction has been excessive, presenting favorable buying opportunities for long-term investors.

2. Pizza Pizza Royalty: (TSX: PZA)

The company’s management attributes the downward revision to unexpectedly prolonged delays in securing new business and the termination of its relationship with a key customer. Despite these hurdles, I believe the market response has been overly harsh, creating advantageous buying opportunities for long-term investors.

3. Telus: (TSX: T.TO)

Currently, Telus offers PureFibre connections to around 3.1 million locations and has extended its 5G network coverage to reach 84% of Canadians. Amid these strategic investments, the company achieved the addition of 293,000 new connections in the second quarter, accompanied by a 1.8% growth in its ARPU (average revenue per user).

Notably, the churn rate remained impressively low at 0.91%. These robust operational metrics are poised to sustain and potentially enhance the company’s financial performance in the upcoming quarters.

4. Suncor Energy Inc.: (NYSE: SU)

Suncor Energy Inc. (NYSE: SU) CEO Rich Kruger is addressing comments he made during the company’s Q2 earnings call regarding climate change goals, explaining them to Canadian lawmakers.

In the dynamic world of Canadian stocks, opportunities abound for investors willing to explore. By understanding the market, evaluating potential investments, and implementing sound strategies, you can navigate the stock market successfully.